New polling finds that about three-quarters of those surveyed aren’t on board with Statistics Canada’s temporarily-shelved plan to access the financial transaction data and personal details of 500,000 Canadians without their permission.

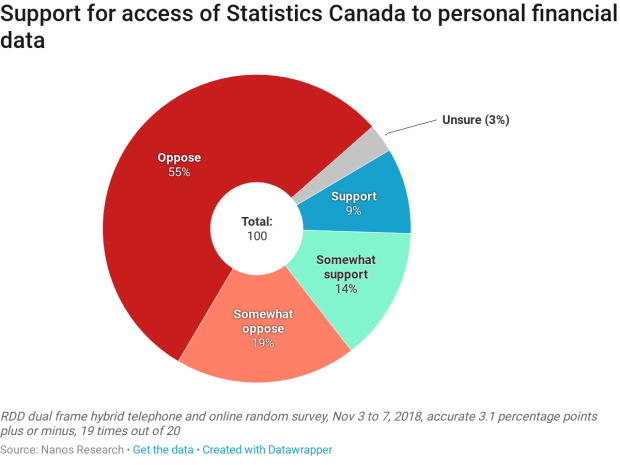

The Nanos Research survey of 1,000 adult Canadians conducted between Nov. 3 and Nov. 7 found that 55 per cent of those surveyed oppose the idea, 19 per cent somewhat oppose it, nine per cent are supportive, 14 per cent are somewhat supportive and three per cent are unsure.

Meanwhile, nearly two-thirds of respondents (64 per cent) agreed that “protecting the privacy of financial data of 500,000 Canadians” is more important than “Statistics Canada better understanding consumer behvaiour and trends.” Twenty-four per cent said the latter was more important. Twelve per cent were unsure.

Prime Minister Justin Trudeau has defended the plan from Statistics Canada, which insists that the “individual record” released to them by banks would not be shared with anyone outside the agency. The opposition Conservatives and New Democrats have criticized the proposal, and Privacy Commissioner Daniel Therrien has launched an investigation.

The survey also asked whether respondents would consent to having personal financial data held with banks shared with Statistics Canada “for the purposes of better understanding consumer behaviour and trends.” Only 30 per cent agreed they would consent, 57 per cent said they wouldn’t give their permission, and 13 per cent were unsure.

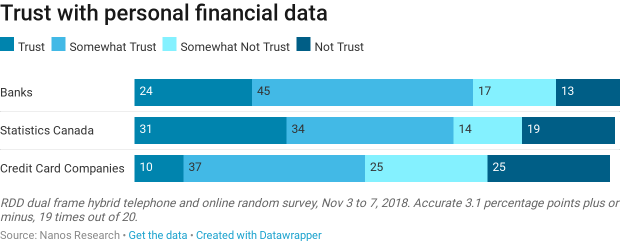

The polling also looked at Canadians’ trust in Statistics Canada, in comparison to banks and credit card companies. It found that banks are trusted the most on two different measures.

Sixty-nine per cent said they trust or somewhat trust banks to protect their financial data, 65 per cent trust or somewhat trust Statistics Canada and 47 per cent trust or somewhat trust credit card companies. When asked specifically about cyber-attacks or data breaches, 61 per cent said they are confident or somewhat confident that banks can protect themselves from outside attacks; only 47 per cent said the same of Statistics Canada and credit card companies.

The polling was conducted using an RDD dual frame (landline and cell) hybrid telephone and online random survey. The margin of error is plus or minus 3.1 percentage points, 19 times out of 20.

With files from The Canadian Press